Set New Goals to Avoid Seller's Remorse

"Set New Goals to Avoid Seller's Remorse" explores the emotional aftermath of selling a business, introducing "One-More-Year-Itis" and offering solutions for moving forward. Through real client experiences, it suggests engaging in new ventures, advisory roles, philanthropy, family reconnection, and personal pursuits, emphasizing the unique opportunity to use time and money for a fulfilling life post-sale.

M&A Advisor Tip

M&A Glossary: One-More-Year-Itis

The propensity business owners have to hang on to their business even after a sale would comfortably fund their retirement goals. Business owners who plan to grow the business “just a little bit more” run the risk that economic conditions could change, creating a negative impact on value that no longer allows them to meet their retirement goals. These owners are typically emotionally tied to the business and can’t let go of someone on a date, while an LOI is closer to an engagement ring.

Market Pulse Survey Q3 2023

M&A Feature Article

Set new Goals to avoid seller’s remorse

I just got a call from a past client who wanted to talk. “I’m happy with the number,” he told me, “but I’m having significant seller’s remorse.” He was still in the process of transitioning out of the business, but it wasn’t his anymore and he felt like a significant piece of himself had been lost.

He was looking for a way to get that back, even though he knew there was nothing we could do. He’d sold his business; that bell had rung and there was no way to un-ring it.

I could certainly validate his feelings. Many of my clients have told me that selling a business is like giving a child up for adoption or sending their teenager to an out-of-state college. They know it’s the right thing to do, but they miss the daily involvement, the challenge, and the companionship.

It’s the same thing with a business. At some point, it makes sense for you and the business to part ways. Maybe the company has outgrown you and needs new leadership to thrive. Or maybe your passion has started to wane, and you’re feeling like work has become a grind.

Either way, you have two options. You can run the business until the day you die, or you can sell and make use of the time and financial resources you gain in exchange. My client had already moved past option one, so now it was time to coach him through option two. I started by sharing what other sellers had done:

Buy Another Business. Some people really need to own a business. Start something small that doesn’t compete with your previous company. Hire the best people right away, so you truly can limit your involvement. Or, help a family member start a business and build the same success you had.

Share Your Knowledge. Another common way business owners channel their energy is by sitting on boards. They take the things they learned over the years and help other entrepreneurs grow. In fact, I talked to one serial entrepreneur who sold his last company and was now sitting on 17 different corporate boards! I don’t recommend 17, but I do applaud the guy for following his passion.

Share Your Leadership. By the same token, numerous nonprofits could benefit from your drive, insight, and connections.

Reconnect with Family. Grandkids can be one of the more positive triggers that get a business owner to sell. I’ve seen many times where one spouse starts traveling to visit the grandkids while the business owner stays behind. First, they’re gone for a long weekend, then a week, and then it’s three weeks at a time, and suddenly the business owner starts realizing all the memories they’re missing out on.

Tackle that Bucket List. Before they sell, I challenge all my clients to create a bucket list. What are the top 10 things you want to do? Is there something you want to buy? A place you want to go? Something you want to gift?

It doesn’t have to be adventurous. Again, it could be tied to reconnecting or helping family. In fact, that’s one thing this particular client had already done: he’d surprised both of his children by paying off their mortgages.

Another seller I talked to had purchased a second cottage next door to his vacation home, so his grandkids could all visit together at one time. They were having a ball, fishing tubing, and skiing.

As a successful business owner, you have the opportunity to gain the gift of both time and money. That’s a rare, amazing thing, and it shouldn’t be taken for granted. Yes, you will miss many things about owning your business, but the solution is to put on your executive hat and get busy planning the next stage of your life.

Article provided by our partners: Cornerstone International Alliance

30 Second M&A Update – M&A trends: Six-month update for 2023

In 2023, the lower middle M&A market is thriving despite a global downturn. Deals are closing rapidly, and businesses are selling near benchmark values. Key trends include a focus on quality acquisitions and a rise in reshoring, particularly in North America, showcasing resilience and opportunities for small to medium-sized businesses in the current market.

M&A Advisor Tip

M&A Glossary: Virtual Deal Room

A deal room is a secure, virtual space where buyers and sellers can share and exchange confidential information related to a potential transaction. Information is typically stored and accessed through a secure online platform that allows users to view, download, and upload documents and other information as needed.

The use of a deal room is essential in M&A transactions because it allows buyers to perform their due diligence in a secure and confidential manner. By limiting access to sensitive information and tracking who has viewed or downloaded content, deal rooms help to minimize the risk of information leaks or other security breaches.

Top deal challenges in the lower middle market

M&A Feature Article

M&A trends: Six-month update for 2023

If you follow global M&A news, you may know that larger deals have seen a slowdown these last six months, as rising interest rates and fears of a banking crisis have affected the market. According to data from Dealogic, global M&A deal volume fell by 17% in the first quarter of 2023 compared to the same period in 2022. Deal value also fell by 37% in the first quarter of 2023.

And yet, according to the Q1 Market Pulse Report from IBBA and the M&A Source, the lower middle market is bucking those trends. Deals are closing faster, and businesses in the lower middle market are still selling at 97-98% of benchmark.

In the Market Pulse report, roughly half of the M&A advisors surveyed said the banking crisis had no impact on their clients, and only 6% said it had lowered business values. Meanwhile, interest rate instability also had limited impact, with only 15% of advisors saying it was creating a challenge to getting deals done.

The lesson here is that big market trends don’t always trickle down. If you own a small or medium business, don’t let the global M&A headlines color your outlook for the year ahead. Talk to specialists on the ground and find out what’s happening in your market:

Market dynamics: The lower middle market remains active, with lenders willing to provide financing. Buyers are increasingly shifting their focus to downstream (i.e. smaller) opportunities where the lenders are still able to support dealmaking.

It is true that new deal volume experienced a slowdown in late 2022, persisting into the first few months of 2023. But around mid-April, many lower middle market advisors reported a sudden surge in seller inquiries. Sellers, who had been hesitant to enter the market for the past six months, have returned. This resurgence is particularly welcome as the industry was experiencing a shortage of available inventory.

Flight to quality: In an uncertain market, we see a flight to quality. That means buyers are increasingly hesitant to take big risks, and are focusing their efforts on stable, proven acquisition opportunities. This also means that the sellers who properly prepare their company for sale are seeing bigger benefits.

In other words, good businesses are selling. One Wisconsin technology company, for example, attracted interest from over 100 potential buyers. They received more than 20 written offers, several above the benchmark.

In Texas, a machine shop received a 7.5 multiple on its $5 million EBITDA–for a transaction value of $37.5 million. That multiple, nearly unheard of for a machine shop, was helped along by the company’s investment in automation. They have the ability to run lights out, meaning certain elements of production can run overnight without on-site staffing.

Shifts in deal structure: While valuations have remained relatively stable, there has been a slight shift in deal structure. Buyers are increasingly seeking to transfer some risk to sellers. This takes the form of seller notes, earnouts, or equity rollovers—options that provide friendly debt or performance-based payment plans to bridge any valuation gaps.

Sellers, in turn, appear more willing to take on additional risk to achieve higher valuations. These adjustments reflect trending negotiation strategies in the current market climate.

In the Midwest, for example, two companies in the marketing space attracted multiple offers. Each of these deals included a portion of cash at close with the rest structured through multi-year earnouts. In one, the seller had the choice between a benchmark offer with 80% cash at close, or an offer with 60% cash at close but a five year earn out opportunity tied to sales that would approximately double the benchmark. The seller chose the larger upside, as it benefited both her and the minority owner on her leadership team.

Reshoring: The manufacturing sector is gaining momentum, driven by an increasing interest in reshoring. With the supply chain lessons of COVID-19 (mostly) behind us, businesses are recognizing the benefits of localized production and supply chains.

In Canada, one plastics manufacturer talked about winning new business that customers had previously outsourced to Asia. While “Made in America” has always held a certain appeal, he’s hearing from customers that “Made in North America” is increasingly gaining prominence.

In conclusion, while global M&A headlines may convey a sense of uncertainty, the lower middle market continues to exhibit strength and resilience. By staying attuned to market dynamics, emphasizing quality, adapting deal structures, and staying nimble, small and medium-sized business owners can maintain business value and maximize their exit options.

Article provided by our partners: Cornerstone International Alliance

How business owners can diversify net worth

These are private family firms established by high-net-worth families to manage their wealth. Much like private equity firms, family offices will acquire, grow, and then re-sell a business as a way to generate financial returns. Many times, they have more patient capital, i.e., they do not have a set timeline in which they need to sell the business.

M&A Advisor Tip

M&A Glossary: Family Offices

These are private family firms established by high-net-worth families to manage their wealth. Much like private equity firms, family offices will acquire, grow, and then re-sell a business as a way to generate financial returns. Many times, they have more patient capital, i.e., they do not have a set timeline in which they need to sell the business.

Market Pulse Survey Q2 2023

M&A Feature Article

How Business Owners Can Diversify Net Worth

Business owners, do you know how much of your net worth is tied up in your business?

When you started your business, it may not have contributed much to your overall net worth. In fact, it may have been a substantial source of unsecured personal debt! But over the years, as your business grew, it’s likely to become your most valuable asset. And if you’re like the majority of business owners, most of your net worth is now tied to the business.

Let’s take a look at hypothetical business owners Eric and Kelley. They started their company in their early 30s. At that point, they had a little home equity and some retirement savings from their former jobs.

Now Eric and Kelley are in their mid-50s. They have $500,000 equity in their home, and their retirement accounts have grown to $600,000. Their business flourished and is now worth an estimated $5 million. All in all, that means Eric and Kelley’s business represents 82% of their net worth.

According to the Exit Planning Institute (EPI) our imaginary business owners are quite the norm. EPI estimates 80% of the average business owner’s net worth comes from their business.

Another study suggests the majority of business owners need to sell their business to fund 60%-100% of their retirement. Some owners are so busy investing in their business that they fail to put aside any other funds for their retirement.

That’s concerning, because many business owners wait until they want to retire to start exit planning. At that point, they may find their company isn’t worth what they thought it was, or worse yet, isn’t salable at all.

Given the significant portion of a business owner's net worth that is typically connected to their business, owners need to understand their business value, exit options, and what diversification could look like:

Get an accurate estimate of your business value. No matter what stage your business is at, it’s important to know what your business is worth and what you can do to enhance that value.

You may have heard that businesses in your industry typically sell for a five multiple of EBITDA or one times gross revenue. But those back of the napkin valuations don’t account for any number of factors unique to your operation that can enhance or detract from your business value.

Plan now for a future sale. Getting a regular estimate of value can help you make informed decisions about the future. This knowledge can guide strategic planning, expansion, investment, or diversification efforts. It also allows you to assess the salability of your business and make adjustments more strategically to make it more attractive to buyers.

Know your independence point. How much would you need in assets and passive income in order to fund your ideal lifestyle in retirement? Once your Net Number (your business value after tax liability and debt) exceeds your Lifestyle Number, you’ve reach your independence point and it’s time to consider your options.

Continuing to run your business past your independence point comes with risks. As we’ve seen over the past few years, market conditions can change rapidly. A business that’s thriving one day could be struggling the next, through no fault of your own.

Granted, you may derive a great deal of personal satisfaction from running a business—purpose, identity, challenge, influence—but at some point you need to decide if those benefits outweigh the financial risks.

Diversifying your net worth. Let’s get back to Eric and Kelley. They’ve run the numbers and talked to specialists. They know they could sell their business and retire comfortably. But they’re not quite ready to walk away. Do they have options to diversify?

Depending on the nature of their business, probably, yes. At this point, Eric and Kelley could take their business to market as a recapitalization strategy. They could sell a minority share to outside investors, allowing them to retain control of their business while diversifying their net worth.

Another option is selling a majority share to a private equity firm that wants Eric and Kelley to continue leading the business. This scenario injects new capital and connections into the company, potentially accelerating its growth. They’ll have the ability to sell their shares at some point in the future, ideally multiplying their financial reward. A partial sale like this will also remove any personal guarantees they may have attached to business debt.

Running a successful business is undeniably fulfilling. However, it’s important for business owners to understand how the business plays into their overall net worth and retirement goals. Make informed, intentional decisions about when to carry the risks of business ownership and when to take some chips off the table.

Top 8 reasons buyers walk away from an M&A deal

Making the decision to pursue a merger or acquisition can be a complicated process fraught with risk. Even when the financials look good and the potential rewards seem great, there are several reasons why a buyer might decide to walk away from a deal. Understanding these reasons can help sellers prepare for negotiations and improve the likelihood of a successful outcome. Here are some of the most common reasons why M&A buyers might decide not to proceed with a deal.

M&A Advisor Tip

M&A Glossary: Estimate of Value

An estimate of what your business is worth. We use the term “Estimate of Value” (EOV) as something distinct from a full, formal certified valuation provided by a Certified Public Accountant or other credentialed valuation person. An EOV is less expensive and serves the same purpose as a valuation because it identifies the fair market value for your company. However, an Estimate of Value will generally not meet the valuation requirements for legal disputes or IRS audits.

Market Pulse Survey Q2 2023

Top 8 reasons why buyers walk away from an M&A deal

Making the decision to pursue a merger or acquisition can be a complicated process fraught with risk. Even when the financials look good and the potential rewards seem great, there are several reasons why a buyer might decide to walk away from a deal. Understanding these reasons can help sellers prepare for negotiations and improve the likelihood of a successful outcome. Here are some of the most common reasons why M&A buyers might decide not to proceed with a deal:

The company is not what it seemed: During due diligence, the buyer may discover that the target company is not what they expected. This could be due to operational issues, poor recordkeeping, inadequate systems, or other concerns. If the buyer believes that these problems will make the deal too risky, they may walk away.

That’s why it’s important to “go ugly early.” In other words, put all the positives and negatives on the table right away, to reduce the chance of surprises ruining a deal later on.

Financial concerns: When evaluating an opportunity, buyers are looking at a company’s financial health and future earnings potential. If, during due diligence, they find significant financial issues, such as declining revenue, over-aggressive addbacks to prop up EBITDA, or inaccurate financial statements, the buyer may stop the deal process.

Cultural red flags: An acquisition involves the integration of people and organizational cultures. Buyers and sellers should have had culture discussions before the letter of intent stage. But sometimes new information reveals itself as the parties work together. If the buyer perceives significant culture differences, they may walk away to avoid potential integration challenges or disruption to their own corporate culture.

Liability concerns: As part of due diligence, buyers will be looking at a range of risk factors. They don’t want to face an unexpected lawsuit or deal with the aftermath of someone else’s improper corporate conduct. Concerns here include ethical and legal issues, including non-discrimination and employment practices, regulatory requirements, and contracts, as well as tax liabilities.

Environmental issues: Many transactions will include an environmental site analysis. Even if you aren’t selling the real estate with the business, the buyers may want assurances that the business hasn’t been the source of any unknown leaks or contamination. Unfortunately, environmental events do occur, and some sellers find themselves tied up in years of environmental remediation issues before they are able to alleviate buyer worries and put their business back on the market.

Strategic shifts: Sometimes changes in the buyer’s business strategy can prompt them to reconsider an acquisition. It’s possible the company’s board of directors or investors won’t approve the deal. Even something as simple as the buyer losing a key executive who championed the deal can sideline an otherwise healthy transaction.

Unresolved negotiation issues: Negotiating an M&A deal requires reaching a consensus on a wide range of deal terms, including price, payment terms, contractual obligations, warranties, working capital, and other deal-specific issues. If the buyer and seller cannot resolve key negotiation points, it can lead to deal termination. Resolving these issues can be a critical point of failure for many deals.

That’s why it’s a good idea to work with an experienced M&A attorney who knows what’s normal and customary for your industry and won’t obstruct your deal with overzealous demands. You want an attorney who will protect your interests, but you also want a proven deal maker, not a deal breaker.

This is also why you want the buyer to outline as many deal terms as possible in the letter of intent (LOI). At the LOI stage, you still have other buyers at the table, giving you more leverage and options.

External factors: Finally, some deals get foiled by external factors outside the buyer’s or seller’s control. For example, COVID-19 killed or delayed many deals. The dot.com and housing busts, 9-11, political shifts, supply shortages, rising interest rates—these are just some of the many events that have stopped deals from moving forward.

It is important to note that walking away from an M&A deal can be costly for both the buyer and the seller. The buyer may lose the money they have already spent on due diligence, and the seller may lose the opportunity to sell their company. However, in some cases, walking away is the best option for both parties.

Before entering into an LOI with a buyer, your advisors can help you check their references and deal history. You want a buyer with a track record of completing deals and staying true to commitments.

How Covid Slumps and Bumps Are Affecting Business Values

M&A Advisor Tip

The Not-So-Discretionary Bonus (BUYER FOCUS)

When buying a business, be wary of adjusted financials that add back discretionary bonuses. Do employees really receive a “discretionary” bonus? If employees have been given bonuses the last three years running, they may be technically discretionary, but I sure wouldn’t want to be the new owner who didn’t pay out in year four.

Make sure the seller gives you detailed explanations in writing for all adjustments so you and your deal team can confirm which adjustments are “real” and you will accept.

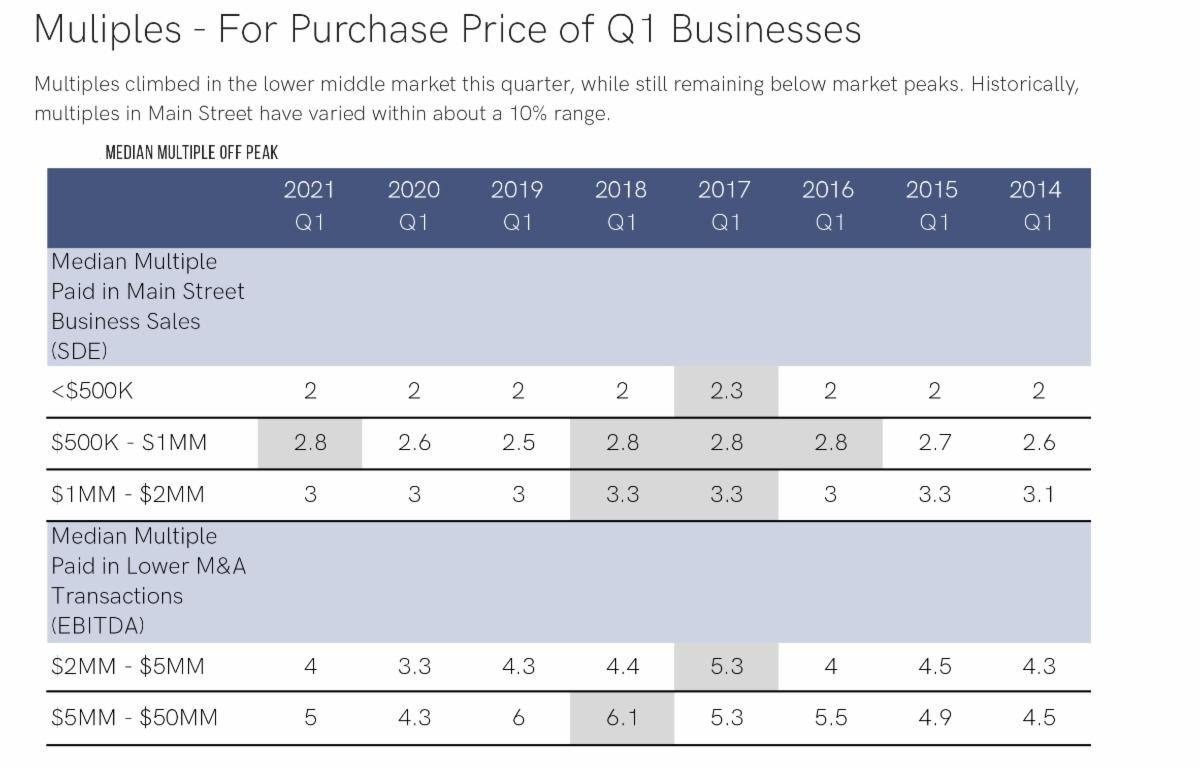

Market Pulse Survey - Quarter 1, 2021

Presented by IBBA & M&A Source

M&A FEATURE ARTICLE

HOW COVID SLUMPS AND BUMPS ARE AFFECTING BUSINESS VALUES

I don’t know of anyone whose business wasn’t affected, at some level, in 2020. Businesses were either on the covid slump or the covid bump.

We have a customer in the food space that caters, in part, to hotels. This customer was able to pivot and introduce some new products that did well in convenience stores, but it wasn’t enough to make up for the hospitality loss.

Some businesses, like gyms, may have lost customers permanently as people brought those experiences in home. For restaurants and stores near big commercial office centers, it could be years before they get back to pre-covid numbers.

On the flip side, there are industries that saw a definite covid bump. Not only did the pandemic not affect them negatively, it gave a substantial boost to their revenue.

We were working with a business in the plastic lumber industry, for example. As people shifted their spending from taking vacations to enhancing their backyards or vacation homes in 2020, this company saw their backlog grow from three weeks to six months.

We talked to a lab testing company. As one of the first in their state able to do covid testing, sales more than doubled. And we talked to an urgent care group with four locations in the southern U.S. They went from $8 million in sales with $1 million EBITDA to $18 million In sales and $8 million EBITDA, mostly from covid testing and front line care.

So whether you were like the majority that had a covid slump, or you’re one of the few lucky ones with a covid bump, the question is how does that affect your value?

What we’re seeing out in the marketplace, for those with a slump or lost revenue who didn’t lose customers, those companies are still salable. The number of buyers out there means the market is still strong, even for businesses that took a hit during the pandemic.

What we’re seeing is that those businesses are still getting pre-covid values. They’re getting cash at close for today’s value and then an earnout or some other kind of alternative financing to cover the gap between where the business is today and where it will be in the next year or three.

That means those businesses who saw a decline (but no significant customer loss) can still get out today and get full value, even if their company isn’t back to pre-covid numbers yet.

For those businesses that only saw a short, maybe 90-day slump, those businesses are not only saleable, but they may achieve a higher multiple because they showed they are somewhat pandemic proof.

For companies that had a covid bump, valuations can be tricky. When valuing a business, we recast the financials to reflect standard operations. That means we “add back” one-time expenses like unusual legal fees or repairs for storm damage.

So now, when buyers see a one-time boost due to covid, they expect to negatively add that back as well. Basically, they aren’t going to value the business based off 2020 performance. They want to show what 2021/2022 will be like.

For the lab business, they believe that covid testing will never go away. We can expect some level of ongoing testing, particularly as different strains emerge. They probably won’t see numbers like 2020 again, but they should have a consistent bump going forward.

For the urgent care facilities, they’re predicting a 20% increase going forward. That includes some testing, but they also believe that some of those new 2020 customers will convert to long-term patrons now that they’ve gotten to know the location and the staff.

The plastic lumber business also expects a boost, thanks to outdoor furniture sales. Perhaps customers bought two tables and a chair this year. In the years that follow, they’ll continue to add more matching pieces as they can afford to expand their sets. They’re also expecting a boost from commercial customers as well, as restaurants continue to extend their patios and outdoor seating.

The takeaway: Buyers have been more empathetic than I expected and will provide allowances for a covid slump, as long as the fundamentals of the business didn’t change. But on the same front, they’re also sophisticated enough to know that they’re not going to pay off a one-time covid bump without some solid justification showing how those sales will convert to ongoing business.

Article provided by the Cornerstone International Alliance

Business Owner Mindset: Balancing Present and Future Success

Due diligence is the process the buyer goes through to ensure a business meets their expectations prior to acquisition. Due diligence serves to confirm the information the seller presented is accurate and that there are no issues that would create risk or otherwise impact the value of the business. Due diligence typically covers commercial factors (product, customers, suppliers, market) as well as financial reporting, environmental, human resources, and legal.

M&A Glossary: Due Diligence

Due diligence is the process the buyer goes through to ensure a business meets their expectations prior to acquisition. Due diligence serves to confirm the information the seller presented is accurate and that there are no issues that would create risk or otherwise impact the value of the business. Due diligence typically covers commercial factors (product, customers, suppliers, market) as well as financial reporting, environmental, human resources, and legal.

Business Owners Mindset: Balancing Present and Future Success

We don’t see a lot of businesses transfer to the owners’ children anymore. Often, business owners tell us their adult kids just aren’t interested in making the sacrifices they saw their parents make, or don’t have the passion for that particular industry.

Instead of taking over the business, they want to go to the cottage for the weekend. They want to see their kid’s soccer games. What they don’t want is late nights of stress and worry, being constantly called to put out fires at the office, and dealing with the overwhelming responsibilities of running a business.

Being a business owner takes a unique mindset. You have to accept that there will be trade-offs. You might have to give up leisure time or personal events in the pursuit of business success. Figuring out how you’ll navigate these challenges requires a clear understanding of both your short-term objectives and long-term goals.

Values and trade-offs: Probably one of the biggest reasons I’m still in this industry is because as a young professional, I moved to Green Bay where I didn’t know anyone. I had zero distractions, and that allowed me to fully immerse myself into learning the industry, morning, noon, and night.

I would get calls from my old college roommates, telling me to come and meet up with them. It was tough missing out on that fun, but I believed I was creating something bigger for myself and my future family.

These are some of the hard decisions that business owners need to make. What are you willing to give up? You may decide that certain sacrifices, such as missing school plays and sporting events, are worthwhile when compared to the long-term vision and the flexibility that successful entrepreneurship can offer. Or maybe you’re not okay with that, but that means you don’t have the capacity to take your business to the next level.

Faced with constant pressure and competing demands, it becomes essential to reflect on your personal values and determine what is really important in your life. Every individual has unique priorities, and there’s no one right choice to make.

Redefining balance: At the end of the day, I don’t think there’s any such thing as a perfect work-life balance. When you’re a business owner, balance is more like a seesaw. There are days I’ll work late and miss dinner, and there are other days I get to sneak out early and go to dinner with friends.

But you can’t be on one side of the seesaw for too long. Pick your timing, pick your hours. If you spend too much time solely focused on your business, you may miss out on important personal moments or burn out. It's important to find a balance that makes sense for you, your family, and your employees. Recognize that there will be an investment of your time and energy, and choose the moments when you can truly go all in.

Being a business owner often requires unwavering commitment. While this may entail missing out on certain personal events in the short term, the focus is on creating something greater for oneself and future generations.

Article provided by: Cornerstone International Alliance